The introduction of the obligation to receive e-invoices in the B2B sector starting in 2025 in Germany marks a significant change in invoicing practices for companies. This development reflects an inevitable trend towards the standardization of financial transactions that is already emerging in many European countries.

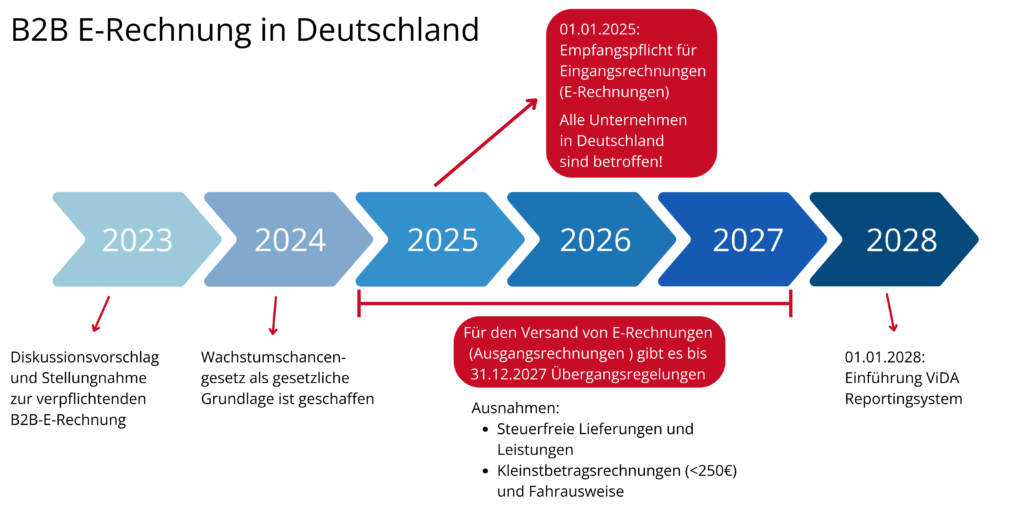

In the B2G sector, e-invoicing in various formats such as XRechnung was introduced as early as 2014 in the first EU countries. Starting from January 1, 2025, all B2B companies in Germany must legally be able to receive e-invoices as well.

What exactly is an e-invoice?

An e-invoice is defined by its form: it is an invoice that is created in a machine-readable, structured format and is transmitted and received electronically. This structure enables automated processing in accounting systems, which reduces manual intervention and increases efficiency.

The European standard EN 16931 forms the basis for the formats of electronic invoices. This standard was developed to ensure the compatibility of invoicing processes across national borders and thus promote efficiency in the European single market.

The essentials:

- From January 1, 2025, all B2B companies in Germany will be required to be able to receive and process e-invoices.

- From 2025, traditional PDF invoices and paper invoices will no longer meet the legal requirements for e-invoices.

- Electronic invoices must be created in a defined, digital format, such as the XRechnung invoice format, the EDI process and the ZUGFeRD invoice.

- According to the DIN EN 16931 standard, these e-invoices must contain more extensive details than traditional invoice formats.

- There are transitional periods for sending e-invoices (outgoing invoices) until December 31, 2027.

What does the e-invoicing obligation mean for your company?

Starting from January 1, 2025, receiving e-invoices will become mandatory for all B2B transactions in Germany. With the introduction of e-invoicing, a distinction is made between “electronic invoices” and “other invoices.” Electronic invoices include formats such as XRechnung, EDI (Electronic Data Interchange), and ZUGFeRD invoices. The standard for electronic invoices is defined by the European norm EN 16931. Simple PDFs or paper invoices will no longer meet these requirements.

From the first day of the regulation, all companies must be able to receive and process e-invoices. This also includes the audit-proof archiving of invoices.

Transitional arrangements and adjustment period

The obligation to receive e-invoices comes into force at the beginning of 2025. There is no transition period here. However, issuers have until the end of 2027 to fully convert their systems to the new requirements. From 2025 to 2027, various forms of traditional and electronic invoices are still permitted, provided they receive the recipient’s consent. Paper invoices and PDFs can be used until the end of 2026. Companies with a turnover of less than 800,000 euros in the previous year may even continue to use these formats until the end of 2027.

From 2028, all B2B companies in Germany must strictly comply with the new requirements for electronic invoices, which marks the complete transition to compliant e-invoices.

Preparation for mandatory e-invoicing

The changeover to digital processing of all incoming and outgoing invoices requires a revision of your internal systems and processes. There are currently no specific legal requirements for the transmission of e-invoices. However, companies are generally expected to set up a system that enables receipt via secure electronic channels such as EDI or Peppol.

As EDI Service Partners and Peppol service provider, we specialize in carrying out this important transition. Our 24/7 service ensures that you can concentrate fully on your core business while we take over the processing of your EDI data and e-invoices.

Why should you not hesitate?

The e-invoicing obligation is coming sooner than you think and will soon affect all European countries. An early changeover will give you a head start and enable you to adapt smoothly to the new legal framework.

Next steps

The e-invoicing obligation is an excellent opportunity to review and optimize your business processes. Let’s tackle this challenge together and make your business processes fit for the future.

If you are interested in fast project implementation and a 24/7 highly available service, and if you want to have peace of mind regarding your EDI operations or e-invoice processing, contact us.

Rapid test: Are you affected?

Find out whether the upcoming changes are relevant for your company:

Is your company based in Germany?

Ja

Please answer the further questions regarding the specific impact.

Nein

You are not currently affected, but similar regulations could soon be implemented throughout the EU.

Does your company operate in the B2B sector?

Ja

Please answer the further questions regarding the specific impact.

Nein

These regulations are not applicable to your company.

Does your annual turnover exceed 800,000 euros?

Ja

With the invoice recipient’s consent for other electronic formats (e.g. pdf), you must have fully implemented the e-invoicing regulations by the end of 2026. Without consent already from 1.1.2025.

Nein

Extended transition periods until the end of 2027 are applicable for your company.

Do most of your invoices relate to amounts over 250 euros?

Ja

Your invoices must comply with e-invoicing standards.

Nein

Small-value invoices under 250 euros can still be issued in traditional formats.